Every 39 seconds, somewhere in the world, a hacker breaks into a system. It could be a hospital, a phone company, or even a government website.

But as soon as the stolen information includes your Social Security number, bank account details, or Medicare records, it doesn’t feel like a news headline — it feels real.

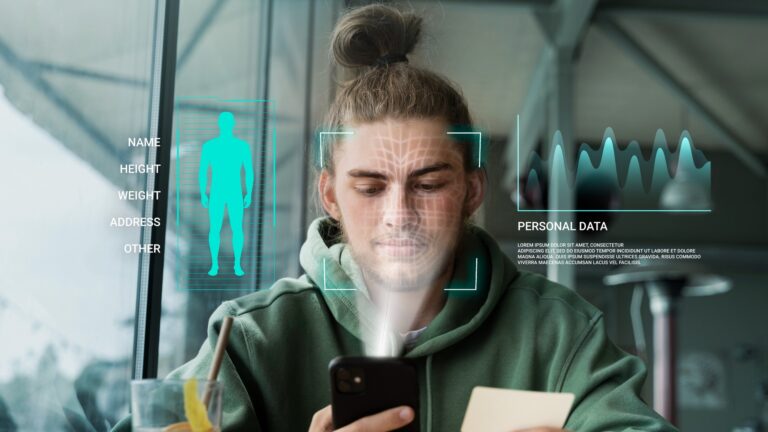

The truth is, most people don’t realize how often their information is stored online. From filling a prescription to paying a bill, your personal details sit inside digital spaces that criminals are constantly trying to break open.

Once they succeed, your information can be sold, traded, and used against you in ways that are deeply personal — from fake Medicare calls to unauthorized loans in your name.

The good news? While you can’t stop breaches from happening, you can stop them from ruining your life. With the right knowledge, a few simple habits, and easy protective steps, you’ll know exactly how to stay one step ahead.

Table of Contents

What Exactly Is a Data Breach?

A data breach happens when criminals break into a company, hospital, or government system and steal its users’ information that was supposed to be locked away.

Think of it like thieves cracking open a bank’s safe — only instead of gold, they steal Social Security numbers, bank details, and medical files.

The types of information stolen in breaches often include:

- Personal details: full name, address, Social Security number, birthday.

- Financial info: credit card numbers, bank accounts, tax records.

- Health data: insurance numbers, prescriptions, and medical visit details.

- Login details: usernames, passwords, security answers.

Unlike a data leak (which is usually an accident), a breach is an intentional attack. Hackers force their way in — and the fallout can last for years.

Why Do Breaches Happen?

If companies promise to protect us, how do breaches still take place even today? Here are the most common reasons:

- Hacker Attacks

Criminal groups use viruses, phishing, or stolen employee logins to sneak into company systems. - Weak Security

Some companies don’t use proper locks, like encryption. It’s like leaving the vault door wide open. - Third-Party Vendors

Even if your bank is careful, a smaller partner company might get hacked, exposing your data anyway. - Old, Unsafe Systems

Hospitals and government offices often use outdated software, which hackers know how to break.

Data breaches are very common also because nearly every organization collects and stores data about you — from Medicare to the grocery store app. The more places that hold your information, the more chances criminals have to break in.

The Life Cycle of a Data Breach

Here’s what typically happens once hackers get in:

- The Breach Happens

Hackers break into a company database and grab your data. - Your Data Goes for Sale

The stolen details are sold on the dark web — a hidden part of the internet where criminals trade stolen Social Security numbers, emails, and bank logins. - Scammers Build Your Profile

They combine pieces from different breaches: your birthday from one, your email from another, your insurance number from a third. - You Become a Target

Soon you may get a fake call from “Medicare,” an email that looks like it’s from your bank, or even bills for credit cards you never opened.

Why Data Breaches Are Especially Dangerous for Senior Adults

For younger adults, a breach might require only updating a password. But for seniors, the risks are higher because criminals know:

- Seniors often have pensions and retirement savings.

- Medicare and Social Security numbers are highly valuable.

- Many seniors trust official-looking calls or letters.

- Even if you’re not online much, your hospital or bank still stores your data digitally.

Here’s What Can Happen:

- If scammers get your Medicare number → they can file false claims.

- If they get your Social Security number → they can open loans in your name.

- If they get your email + birthday → they can send very convincing phishing emails.

The danger isn’t just about money. It’s also the stress, wasted time, and emotional toll of fixing identity theft.

Real-World Examples of Notorious Breaches

- Change Healthcare Breach (2024–2025)

In February 2024, hackers hit Change Healthcare. By mid-2025, UnitedHealth reported that 192.7 million people were affected — making this the largest U.S. healthcare breach ever. Data included Social Security numbers, health claims, and insurance details.

2. AT&T Breach (2024)

In March 2024, AT&T confirmed that a massive data set with information from about 73 million current and former customers had been stolen and posted online. This included names, addresses, phone numbers, account numbers, Social Security numbers, and even account passcodes.

3. CMS Medicare.gov Account Incident (2025)

In mid-2025, the Centers for Medicare & Medicaid Services (CMS) announced that 103,000 Medicare users had fake Medicare.gov accounts created in their names. Stolen details were used to set up these accounts.

These cases show that breaches don’t just affect tech companies — they hit healthcare, phone carriers, hotels, and more.

And here’s the catch: breached data never really disappears.

Criminals recycle stolen info for years, combining it with new data to build your complete profile.

How to Know If Your Info is Found in a Data Breach

Unlike a scam call, a breach isn’t obvious. You usually won’t find out right away. Instead, the first clue may be:

- A letter from a company admitting your info was stolen.

- Strange credit card charges.

- Scam calls where the caller already knows your birthday or address.

- Password reset emails you didn’t request.

What To Do If You’re Caught in a Breach

| What To Do | How To Do It | Why It Matters |

| 1. Change Your Passwords | Start with your email, bank, and Medicare accounts. Use three nonpersonal hyphenated words plus numbers (e.g., River-Phone-Tree-1947). | Prevents scammers from logging in with stolen details. |

| 2. Turn On Two-Factor Authentication (2FA) | Go to your account’s Security or Login Settings, find Two-Factor Authentication, and follow the steps to add your phone number. You’ll then get a text or call with a code each time you log in. | Adds an extra layer of security and stops criminals from breaking in with just your password. |

| 3. Freeze Your Credit | Contact Experian, Equifax, and TransUnion. Freezing credit is free. | Blocks thieves from opening loans or credit cards in your name. |

| 4. Check Your Credit Reports | Visit AnnualCreditReport.com. Review for accounts or loans you don’t recognize. | Helps you spot identity theft early. |

| 5. Monitor Your Accounts | Review bank and credit card statements weekly. Set up text alerts for every transaction. | Lets you catch suspicious charges right away. |

| 6. Report Fraud Quickly | If you see something off, call your bank immediately and file a report at IdentityTheft.gov. | Acting fast reduces damage and speeds up recovery. |

Final Thought

Data breaches may sound overwhelming, but remember this: knowledge is power. Once you know how breaches happen and the simple steps to take — like freezing your credit, changing your passwords, and monitoring your accounts — you take control back from the criminals.

You can’t always stop a breach, but you can stop it from breaking your life. So keep these tips handy — and share them with the people you care about. The more we all stay informed, the harder it becomes for scammers to win.

At Futureproof, Kevin makes online safety feel human with clear steps, real examples, and zero fluff. He holds a degree in information technology and studies fraud trends to keep his tips up-to-date.

In his free time, Kevin plays with his cat, enjoys board-game nights, and hunts for New York’s best cinnamon rolls.